Group CEO explains ERG’s outlook for 2017

Benedikt Sobotka, CEO of Eurasian Resources Group: ‘Industrial commodities will continue to perform well in 2017.’

‘2016 has been a rollercoaster year for the mining sector. We had a miserable January and generally volatile first quarter, then we saw range-bound markets for the following two quarters and we ended the year with a bang.

The iron ore market has been the biggest surprise of 2016. We hadn’t envisaged USD80/t during this decade’s timeframe, let alone last year. Following the US election, we have a huge sentiment boost in consumer and business confidence in the US acting as a support to prices in anticipation of both major infrastructure spending and serious tax cuts. Most importantly, China’s steel output in 2016 has been much stronger than expected, rising 5% YoY in November alone, lifting demand for iron ore. We believe that steel and iron ore prices will remain resilient in 1H17, driven by further restocking by steel mills, stronger demand for high-quality steel and scrap capacities displacement in China.

Furthermore, we think that China will continue to shape the commodity demand growth path in 2017 as its main economic planner, NDRC, has accelerated infrastructure projects in the fourth quarter of 2016. Generally constructive Chinese macro data is providing solid support and the latest data for November is consistent with economic stabilization (industrial production is up 6.2% YoY, FAI increased 8.3% and retail sales are up 10.8%). We expect a conscious effort to avoid repeating the mistakes of 2015/16, and hence steady and sustainable increases in demand and prices rather than sharp spikes as in 2016 as part of the Beijing’s measures to support its GDP growth target above 6.5%.

The ferroalloys market was no exception to the swings and movements present in other commodities markets last year. The price declined in Q1 owing to concerns about China and a potential global economic slowdown. Yet a recovery came soon after with prices returning to more justified levels. The subsequent development of the chrome ore and the high-carbon ferrochrome markets since Q2 and particularly in Q4 even exceeded our expectations for a gradual recovery. We have instead witnessed an impressive rally off the back of strong demand and a shortage of supply caused by the fall in prices during the end of 2015 and early in 2016. The price level today exceeds previous heights seen back in 2008. This positive outlook underscores our projection that the future price levels for chrome will remain at profitable levels that justify investment in production to meet future demand. We also anticipate a continued central role for Kazakhstan, as a leader of the respective product markets it can meet increased demand from China and globally.

The copper market is another wonderful example of unexpected turns. I believe that the market still doesn’t fully appreciate how much the environment has changed for copper and not just sentiment-wise. China’s refined copper consumption should continue to define expectation, driven by new infrastructure projects, strong demand for power cables and improving demand in the wider economy. We also believe that a significant copper market deficit may materialise earlier than the 2020 turning point that many are predicting.

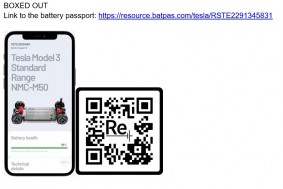

We think that the aluminium market will continue to benefit from the buoyant transportation sector with China now extending tax cuts on small-engine vehicles to 2017. But perhaps my biggest passion is another market associated with the automotive industry, and new energy vehicles in particular; - I am talking about the cobalt market. Tesla has made electric cars cool and highly desirable, and we would like to bring a similar vibe to the cobalt sector, which plays an essential part in shaping the EV market. After gaining 50% YTD, I believe that the cobalt market still has a fantastic potential for 2017.

All in all, our view is that industrial commodities will continue to perform well in the first half of 2017 in the run-up to China’s Party Congress in November this year. Our top picks are copper and cobalt, although iron ore could continue to surprise on the upside.’